Is the Impact of Bitcoin’s Widely Trusted Halving Cycle Weakening?

Bitcoin’s halving event is the most famous oasis of predictability throughout a famously volatile cryptocurrency landscape. But are the rallies that occur in its wake weakening over time?

İçindekiler

Expectations for Bitcoin, the world’s oldest and best-known cryptocurrency, are high in 2024. Following the long-awaited SEC approval of Spot Bitcoin ETFs, the asset has already surpassed its old all-time high value and reached a blistering peak of $73,737.94 in March, with many investors believing that the best is yet to come.

This is because the next Bitcoin halving event is fast approaching. With many crypto platforms showcasing their countdown timers towards April 21st and what will be the fourth iteration of a halving in the coin’s 15-year history, all eyes are on the seismic bull run that it will herald for BTC and the crypto landscape as a whole.

There’s good reason for the optimism, too. Bitcoin has never failed to embark on a major market rally in the wake of a halving event and is in a rare position having broken new ground before its halving. But could investors expecting history to repeat itself be left disappointed?

The Significance of The Halving Event

Let’s first cover what Bitcoin’s halving event is and how it works. When Bitcoin was created by the pseudonymous and ever-mysterious Satoshi Nakamoto, the coin operated on a proof-of-work framework.

This meant that the cryptocurrency would be ‘mined’ through the use of computational power. Here, miners would use their computers to generate new blocks on Bitcoin’s blockchain and be rewarded for their efforts in BTC.

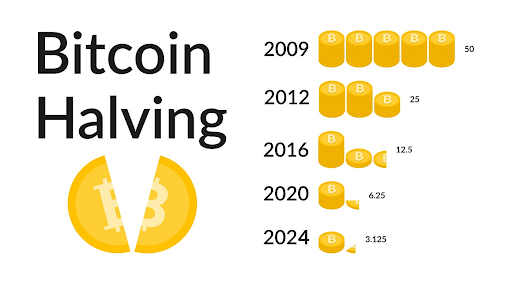

Bitcoin was designed to be a deflationary asset, and because of this, the volume of BTC distributed to miners was programmed to be cut by 50% on a four-year basis.

This meant that the initial 50 BTC distributed to miners for every block created was cut in half to 25 in the first halving event, before falling to 12.5, then 6.25 in 2020. On April 21st, this mining reward will fall to 3.125, meaning that miners will now be earning less than one-tenth the BTC they would’ve received in the years following its launch.

Why is this significant for Bitcoin’s price? With every halving event, the supply of Bitcoin is significantly limited. This actively makes the cryptocurrency increasingly scarce over time.

It’s for this reason that Bitcoin’s scarcity is directly related to its extraordinary price rallies. With a maximum circulation of 21 million BTC that can ever be created, miners have already minted more than 19,665,000, meaning that we’re less than 1.5 million BTC from reaching its total circulation.

As a result, investors are left buying into an extremely scarce and finite supply of a digital asset, hence why its value rallies each time its distribution is cut in half.

Stock-to-Flow Shows a Rare Pattern Amid Volatility

Both Bitcoin and the wider cryptocurrency landscape are so volatile in comparison to more traditional investment options that it can be extremely difficult to identify long-term trends or patterns.

However, Bitcoin’s Stock-to-Flow (S2F) model stands as a rare recurring pattern due to the cyclical nature of its halving event.

As we can see from the Bitcoin S2F model, it’s also been relatively consistent in terms of historical performance. Each halving event leverages a 12-18-month rally towards a fresh all-time high value before a sharp correction sends the coin lower for the years that follow.

According to S2F data, these all-time highs are generally reached between 1,000 and 700 days before the next halving event takes place.

Using past performance to anticipate what’s next for Bitcoin, this particular S2F model anticipates that the price of BTC will peak at around $443,000 by May 2nd 2025–just over one year on from its halving.

But could such an astronomical figure really be achievable? There are growing levels of skepticism over the impact of Bitcoin’s famous halving events.

Weakening Trends

Bitcoin’s weakening halving trends may stem from a little too much of a good thing. While many investors have long anticipated the arrival of institutional adoption, they’ve inadvertently kept BTC and the wider crypto landscape more anchored, lowering volatility throughout the landscape.

While this has helped Bitcoin to hold its value better in bear markets and those long-term ‘crypto winters’ that consistently occur in the wake of post-halving rallies, it may also be dampening the impact of BTC bull runs.

Looking at historical evidence, we can see that Bitcoin’s 2012 halving event brought a price rally of 8,691% over the 12 months that followed and a peak price of $1,137 almost precisely one year later. The July 2016 halving paved the way for a rally of 295% over the year that followed but featured a later peak of $19,041 by December 2017. Finally, May 2020’s halving saw a rally of 559% one year on towards an eventual November peak of $67,734.

Given that post-halving rallies appear to be getting longer, we can zoom out to see that the rally experienced in 2016 from halving to its 2017 peak was closer to around 2,800%, while the 2020 rally remained close to its one-year growth rate of 559%.

This weakening effect has been made all the more aggressive due to Bitcoin’s relative resilience to the volatility that was prevalent throughout the crypto landscape in the 2010s. So should investors lower their expectations for the year ahead?

Halving Washout?

Another mitigating factor to consider is the fact that Bitcoin has already reached a fresh all-time high ahead of its halving event, whereas historically the coin has been trading at between 40% and 50% of its peak value.

The prosperous start to 2024 for Bitcoin has been down to the launch of the world’s first Spot Bitcoin ETFs, which began trading in January.

However, the impact of the Bitcoin ETFs could bring new challenges to the landscape in the wake of the halving, and a slowdown of inflows to the exchange-traded funds alongside a high volume of unrealized gains from traders may even push BTC into bearish territory following its April halving event.

Despite this, Maxim Manturov, head of investment research at Freedom Finance Europe, believes that the supply and demand dynamics of Bitcoin ETFs could accelerate the price of BTC in the future.

“The launch of a Bitcoin Spot ETF is an extremely significant event for the crypto market world as a whole and is creating a supply and demand imbalance,” explained Manturov. “ETFs from Wall Street titans like BlackRock and Fidelity are investing directly in Bitcoin and buying up more and more of the available supply.”

“Since the beginning of February, approximately 3500-4300 BTC have been purchased daily through spot Bitcoin exchange-traded funds (ETFs), with daily production of around 900 BTC. This significant demand outweighs the available supply in the market, fuelling price increases. This imbalance between supply and demand emphasizes the potential for further price increases in the near future.”

How High Could Bitcoin Go?

For investors banking on Bitcoin following familiar patterns, it may be worth exercising caution for the months ahead given that the cryptocurrency is already trading at all-time highs in 2024.

However, it may be worth taking on board more contextual cues from wider financial markets. The Bitcoin halving and market rally of 2020 and 2021 took place at an exceptional time for global economies where government stimulus packages during the pandemic provided investors with more liquidity.

Meanwhile, Bitcoin’s biggest correction came at a time when markets were waking up to the prospect of historically high inflation rates and the likelihood of more hawkish monetary policy from central banks.

Bitcoin’s performance in 2024 is exceptional because of both the launch of Bitcoin ETFs and the expectation of base rate cuts from the Federal Reserve bringing more optimism into the markets.

If historical trends are to be followed, the weakening performance of Bitcoin’s halving event may see growth of 200% towards a prospective new all-time high of around $140,000-150,000, but wider macroeconomic conditions need to be taken into account.

As a result, it’s certainly worth investors avoiding complacency. Bitcoin is famous for confounding critics and bearish expectations. In the world of cryptocurrency, the sky’s the limit–but making it to the moon is another matter entirely.